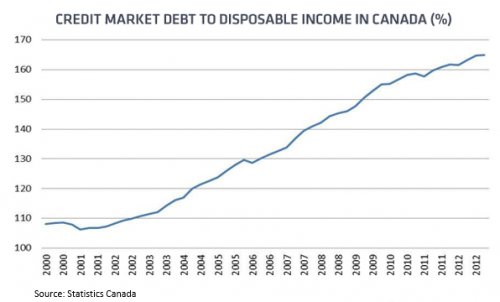

Over the past 15 years Canadian consumer debt has risen dramatically. Since 2000, the percentage of Canadian debt in relationship to disposable income has risen from 110% of income to about 165%. The change in debt to income ratio represents a 12 year increase of 50%.

The old adage about “people should live within their means” has validity no doubt in many cases, but such maxims simplify the complexity of economic influences and impacts and in this case categorically blame individuals for their debt problems. It’s akin to telling people living in poverty to just buck up and get a job. Stop being lazy and all of that.

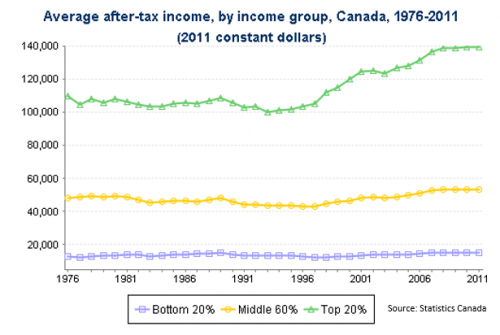

Does rising debt have a correlation to slow if any growth in income for Canadian workers? The chart that follows tells a disconcerting story about after tax income in Canada by three cohorts: the top 20% of earners, the middle 60%, and the bottom 20%. The chart goes back much further in time than the chart above and ends in 2011, but the trends are very clear.

From 1976 the trend in after tax income growth was about the same for all cohorts. In the latter 1990s, however, things changed. Income for the top 20% has escalated quite markedly since then, whereas income growth for the 60% middle earners and the bottom 20% have been small at best.

As the majority of Canadians have experienced flat to very small growth income over the years, they have also experienced far more growth in the expenditures required to house themselves, feed and clothe their families, and so on.

In Edmonton, where I live, the cost of rental accommodations increased on average by 75% between 2000 and 2010. Incomes for the large majority of city residents did not experience such gains. Add rising costs of food over that same period of about 5% per year on average, and the income to expense challenges are obvious.

The more one spends to survive, the less likely it is that they will save for a rainy day, much less for retirement or even a short vacation. This contraction on disposable income creates vulnerability for people. When faced with a family emergency or job loss, even job loss for a short period of time, the options are few. Using one’s credit cards are among the few options available.

The more one spends to survive, the less likely it is that they will save for a rainy day, much less for retirement or even a short vacation. This contraction on disposable income creates vulnerability for people. When faced with a family emergency or job loss, even job loss for a short period of time, the options are few. Using one’s credit cards are among the few options available.

The Canadian Payroll Association has done annual surveys for a number of years and each year the results indicate that between 45 to 50% of Canadian workers are living pay cheque to pay cheque. The loss of a job to them would, according to the Association, result in serious threats to maintaining their housing. This suggests that half of Canadian workers, while not necessarily qualifying as living below the poverty line while employed, are economically vulnerable to disaster should their pay cheques be lost or interrupted, even for a short period of time.

There are other life experiences that lead to unmanageable levels of consumer debt. Divorce plays a role for many, in particular women who leave the relationship with children to care for, and all too often insufficient, if any, child support. Add to this that the majority of women earn less income than men and we end up with single parents financing their transition from marriage to single parenthood with debt.

Health problems can exacerbate debt as well. Temporary absences from work for surgery, for example, plus recovery time add to the fray. Even those with health and short term disability benefits experience reductions in income during those periods of time. And those without any such benefits are left without any supports from their employer. In Ontario, for example, one-third of workers do not have extended health and dental benefits, according to the Wesley Institute.

Of course debt problems are also caused or at least magnified by a lack in money management skills and other aspects of financial illiteracy. Increasing knowledge and skill about money should be attended to, but to think financial illiteracy is a panacea answer would be both impractical and irresponsible.

Rising consumer debt is not just an economic problem in and of itself. It is part of an overall pattern of systems and values that work to keep worker costs as low as possible to order to drive up margins and that fosters and sustains discriminatory practices that stymie participation in the economy by women, visible minorities, Indigenous people, the disabled, as well as older and younger workers.

As a general rule unemployment rates and levels of income are higher in the former and lower in the latter for these populations. How come? Do we really believe that such populations do not measure up to the mainstream of the workforce in terms of skills, experience, and work ethic?

There is an irony in all of this. While there is a tendency to blame individuals for accumulating unmanageable debt, our economy is based on growing profits and to do so products and services are pervasively and unrelentingly marketed to grow sales. Persuasive advertising is fundamental to such growth in profits and it tends to work, resulting in too many people purchasing what they want more so than limiting themselves to what they need. In other words, one could argue that we are happy when a sale is made but then critical of those who grow their debt because the advertising worked.

We are seeing progress in addressing some of the factors mentioned above. There is a growing and welcome trend across the nation around employers paying a living wage. For many workers, especially those that have employer-based health and dental benefits, this will make a difference. Paying a living wage is connected to paying a fair wage, but on its own the living wage movement is a partial answer. For example, the cost of living for a single mother with two young children will more times than not be far greater than an increase in income brought about by a living wage.

If we want to turn the tide on economic vulnerability and poverty in Canada, we need to act on the income problem systemically. Child Tax Credit payments are helping and do lift many out of poverty, but for too many the transfers are insufficient.

Canada’s universal health care system is not really universal. For example, unlike many if not most countries with universal health care, we lack a national pharma benefit. Without employer-based benefits, the cost of medications can mean that Canadians are not able to buy them, which eventually leads to higher public expenditures on hospitalization for acute and chronic care. Add to this mix the dramatic trends in length of life, one has to wonder how a rapidly growing number of senior citizens living into their 80’s will be able to manage their health care costs without a pharma plan.

Tax reform has a place in the changes we need to make, but on its own is not the answer either. While it seems reasonable for the super-rich to pay more taxes and have less access to opportunities to avoid taxation, the bigger challenge has to do with how governments see priorities, how they decide to spend our money. Systems change that doesn’t address this will be hard pressed to effect substantive change.

Tax reform has a place in the changes we need to make, but on its own is not the answer either. While it seems reasonable for the super-rich to pay more taxes and have less access to opportunities to avoid taxation, the bigger challenge has to do with how governments see priorities, how they decide to spend our money. Systems change that doesn’t address this will be hard pressed to effect substantive change.

Attitudes and values need to be assessed as well. There is an emerging movement to consider human rights in our economic and social decision making. If in a democracy we believe people should be treated equally and have at least equitable opportunities to participate in the economy and in social living, what are the human rights that should guide decision-making?

Our systems appear to place more value on those who are working and doing well than on others who are struggling or who for a variety of reasons cannot work at all (e.g. the mentally ill). While there is a general acceptance that governments should provide income security programs for those who are between jobs or who can’t work at all, there is little, if any, justification for the inadequate financial benefits these income security programs provide. Across the country, at least from what my own research has uncovered, income security benefits do not come close to what it costs to be alive in Canada.

There is encouragement to be found in governments that are exploring a Guaranteed Minimum Annual Income as well as adopting living wage policies and practices in their own shops, but if we carry the same sentiments that keep current benefits far lower than what is reasonable, then I fear a GMAI, for example, will fall far short of the mark. Program changes unaccompanied by a shift in values will at best produce inadequate progress.

While there is a growing understanding that poverty is not just about money, let’s be careful that we don’t step away from the undeniable impact that a lack of income has on people’s lives. The millions of Canadians living on low and unstable incomes may benefit from more social inclusion or subsidized public transit or free passes to recreational facilities, but such programs, although welcome, will not turn the tide of the biggest most pervasive aspect of living in poverty, which is a lack of sufficient income to survive, much less thrive.

Across the country, local communities are taking charge of poverty reduction and this is exactly where such leadership should come from. Local economic reforms are possible in local communities but without addressing national and provincial systems that work to marginalize people of low income and keep them poor, we won’t win the battle. Which is another way of saying, despite our progress, we have so much left to do and we need to foster ways to improve our systems together, across all sectors.

Further Your Learning

- Vibrant Communities Canada - Cities Reducing Poverty

- Time to reframe poverty as a matter of human rights (Maytree)

- Living Wage Canada

- Canadian household debt soars to yet another record

- Canadians living paycheque to paycheque, especially in Ontario and B.C., survey warns

- Canada needs a national pharmacare plan: Editorial

- Explore more blogs by Mark Holmgren